Statistik Asas

| Pemilik Institusi | 31 total, 30 long only, 0 short only, 1 long/short - change of -14.63% MRQ |

| Purata Peruntukan Portfolio | 0.0371 % - change of 42.84% MRQ |

| Saham Diterbitkan | shares (source: Capital IQ) |

| Saham Institusi (Panjang) | 16,862,584 - 59.74% (ex 13D/G) - change of -0.02MM shares -0.54% MRQ |

| Nilai Institusi (Panjang) | $ 13,061 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

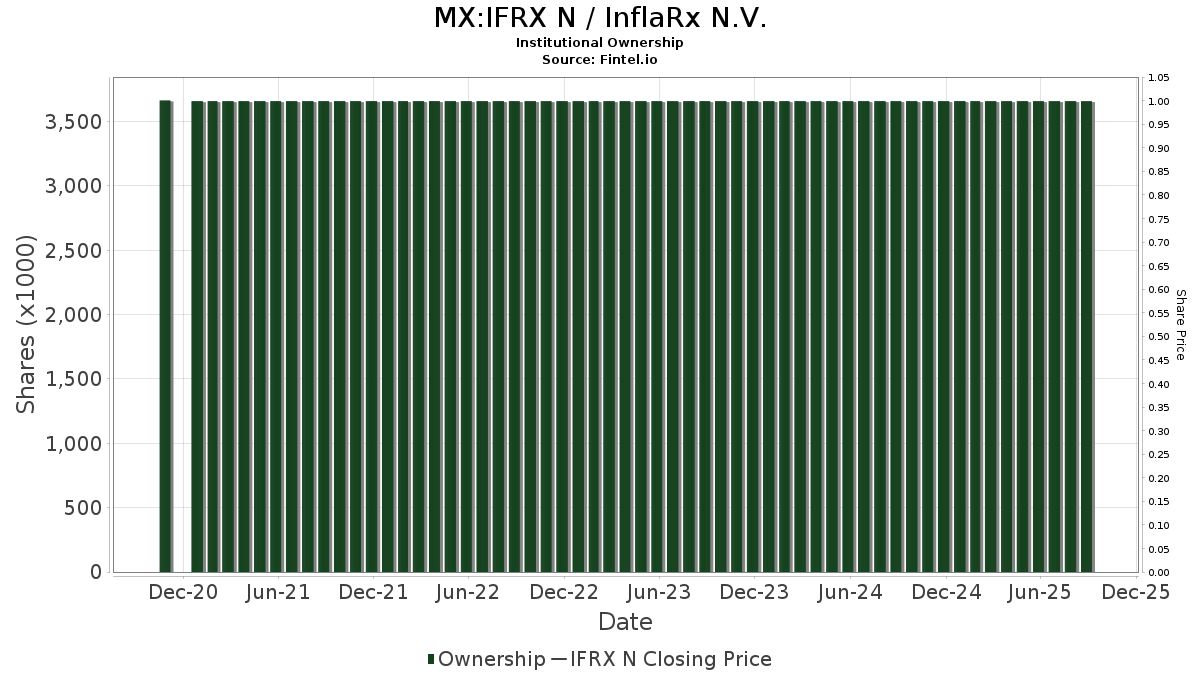

InflaRx N.V. (MX:IFRX N) telah 31 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 16,862,584 saham. Pemegang saham terbesar termasuk Suvretta Capital Management, Llc, 683 Capital Management, LLC, Ra Capital Management, L.p., Eversept Partners, LP, Woodline Partners LP, Ikarian Capital, LLC, Morgan Stanley, Raymond James Financial Inc, Adage Capital Partners Gp, L.l.c., and DAFNA Capital Management LLC .

InflaRx N.V. (BMV:IFRX N) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.

| Tarikh Fail | Sumber | Pelabur | Jenis | Purata Harga (Ang) |

Saham | ΔSaham (%) |

Nilai Dilaporkan ($1000) |

Δ Nilai (%) |

Peruntukan Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-05-12 | 13F | Jpmorgan Chase & Co | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Ra Capital Management, L.p. | 1,973,233 | 1,559 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 98,800 | -9.19 | 78 | -29.09 | |||

| 2025-08-12 | 13F | Virtu Financial LLC | 60,415 | 0 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 17,600 | -16.59 | 14 | -38.10 | ||||

| 2025-08-14 | 13F | Silverarc Capital Management, Llc | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 527,166 | -16.61 | 416 | -35.40 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 600 | -97.98 | 0 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 100 | 0 | |||||

| 2025-08-14 | 13F | Adage Capital Partners Gp, L.l.c. | 331,113 | 262 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 25,712 | 0 | ||||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 25,000 | 20 | ||||||

| 2025-05-15 | 13F | Federation des caisses Desjardins du Quebec | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 1,301 | 0.00 | 1 | 0.00 | ||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 43,672 | -9.27 | 35 | -46.97 | ||||

| 2025-08-14 | 13F | StemPoint Capital LP | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-21 | 13F | Franklin Street Advisors Inc /nc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 2,200 | 57.14 | 2 | 0.00 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 57,951 | 0 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 8,095 | 6 | ||||||

| 2025-07-14 | 13F | Pacifica Partners Inc. | 14,210 | -30.97 | 11 | -47.62 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 43,530 | 305.91 | 0 | |||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 158,058 | 0.00 | 125 | -22.98 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Ubs Oconnor Llc | 150,000 | 158.30 | 118 | 100.00 | ||||

| 2025-05-15 | 13F | Two Sigma Investments, Lp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | DAFNA Capital Management LLC | 200,000 | -55.56 | 158 | -65.58 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-14 | 13F | Birchview Capital, LP | 50,000 | 0.00 | 40 | -23.53 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Woodline Partners LP | 751,267 | 0.04 | 594 | -22.58 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 146,034 | 172.89 | 115 | 112.96 | ||||

| 2025-08-14 | 13F | Eversept Partners, LP | 1,640,430 | -2.12 | 1,296 | -24.22 | ||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 0 | -100.00 | 0 | |||||

| 2025-05-15 | 13F | Schonfeld Strategic Advisors LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-15 | 13F | Morgan Stanley | 693,854 | -45.00 | 548 | -57.39 | ||||

| 2025-08-13 | 13F | Advisor Group Holdings, Inc. | 7,500 | 19 | ||||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100.00 | 0 | |||||

| 2025-05-15 | 13F | Bank Of America Corp /de/ | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 43,672 | -9.27 | 34 | -30.61 | ||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 32,700 | -2.68 | 26 | -26.47 | |||

| 2025-08-14 | 13F | 683 Capital Management, LLC | 2,475,000 | -5.71 | 1,955 | -26.97 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-05-15 | 13F | Two Sigma Securities, Llc | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Ikarian Capital, LLC | 705,010 | 557 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 144,000 | 35.21 | 0 | |||||

| 2025-08-14 | 13F | Suvretta Capital Management, Llc | 6,483,910 | 0.00 | 5,122 | -22.55 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 82,651 | 65 |